The Home Depot DIY Retail Store Front with Sign Lokibaho/iStock Unreleased via Getty Images

HD Stock’s Key Metrics

Home Depot (NYSE:HD) is the number one home improvement retailer with an estimated 17% market share in the United States. Most of the company’s sales growth is driven by various home improvement projects that are undertaken by either DIY homeowners or professionals on behalf of homeowners. Home Depot’s sales are evenly split between DIY homeowners and Pros. This is unlike HD’s rival Lowe’s Companies (LOW), whose majority of sales comes from DIY customers.

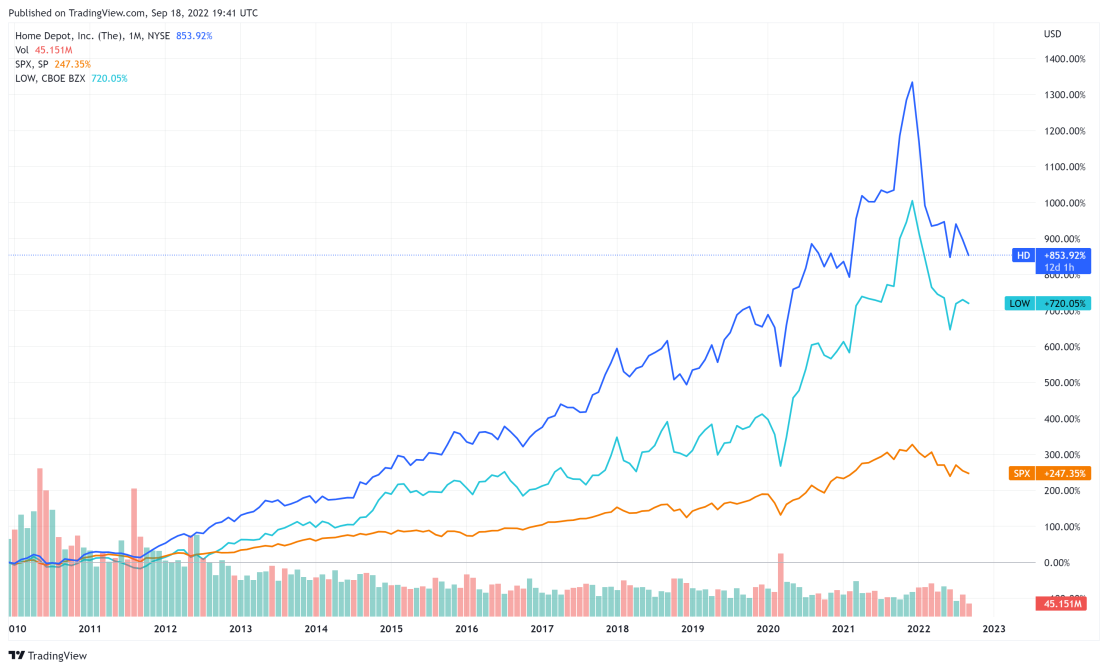

Throughout the years, HD showed significant market outperformance, which became especially noticeable during the last three years when Covid-19 hit:

Figure 1. Home Depot, Lowe’s Companies and S&P500 Price Performance

Stock Price Performance of Home Depot, Lowe’s Companies and S&P500 Market Index (TradingView)

Home Depot’s stock performance outpaced not only the S&P 500 but also its closest rival, Lowe’s Companies, Inc. Behind this meteoric rise over the past 10 years is significant organic sales growth and margin expansion. While HD’s store count barely budged, there were impressive store productivity gains, which were at the core of excess comp growth.

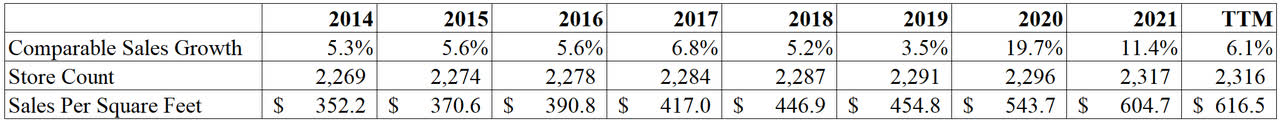

Table 1. Home Depot’s Sales and Store Count

Home Depot’s Sales, Store Count and Productivity (Company’s Filings)

Looking at table 1, the company’s sales per square feet grew by a staggering 7% CAGR rate over the seven-year period. A lot of this productivity growth has to do with supply chain buildout. With various new fulfilment centers, service hubs and distribution centers that specifically cater to professionals, Home Depot’s management estimates that they opened an equivalent of 200 new stores in terms of their capability to drive incremental sales.

HD greatly benefited from Covid-19 lockdowns, as not only the company’s stores remained open, but also consumers stayed at home and undertook a large number of home renovation projects. Currently, the company is in the demand normalization phase, as its comps are gradually falling off. This resulted in a 30% stock decline from the peak in December 2021 and Home Depot’s stock is within a 10% deviation from its pre-pandemic high. Among other things that are on investors’ minds that contributed to this plunge are high inflation, a slowdown in housing market appreciation, rising mortgage rates and a slowdown in consumer discretionary spending.

Is HD Undervalued Now?

Home Depot is fairly valued. While all the concerns I mentioned above will no doubt cause short-term turbulence for HD’s stock, most of these factors have likely already been priced in. Moreover, further downside is very unlikely due to favorable long-term positive prospects from aging housing and supply constraints for new houses. These trends will overshadow any short-term demand slowdown that is happening at the moment.

Persistent Home Remodeling Trend

The housing market in the U.S. is showing signs of slowing growth. Particularly, the national home price index is showing a sign of turning, as affordability becomes an issue for homebuyers. Moreover, the housing index maintained by the National Association of Home Builders shows clear signs of a slowdown of new homes sales and turned below 50 in August of 2022. Finally, there is headline news on how mortgage rates are skyrocketing and are above 6%.

Home price appreciation has been historically important for Home Depot and material declines in home prices may adversely affect its business, as the negative wealth effect kicks in. However, there is still a supply shortage of homes. Depending on the source, this shortage ranges from one to four million single-family homes with some estimates citing a three million number. This housing shortage is not expected to go away any time soon. So even if home prices stop rapid appreciation, as they did in the last two years, low-single-digit home appreciation is very likely going forward given the housing deficit. I deem this sufficient for Home Depot’s business to continue growing.

Next, consider mortgage rates. There are 130 to 140 million housing units in the U.S. Of those, only 4% to 5% change hands each year. This is a relatively small number that affects Home Depot’s business to a lesser degree. What can have an impact on HD is the overall level of interest rates. If interest rates get beyond a certain tipping point, households who use credit to conduct home improvement projects may consider delaying maintenance or repairs. This could be a risk worth contemplating.

Despite a slowdown in price appreciation and sales of new homes, the home improvement market remains resilient, as evidenced by the NAHB remodeling index, which had a reading of 77 in Q2 of 2022 (numbers above 50 indicate bullish remodeling market). Even though the index number slipped from 86 in Q1 2022, the reading remains healthy, though it is slowing down. According to NAHB’s forecast, the growth rate for the remodeling market will outpace that of single-family construction in the next several years. Home Depot has been reporting on the last quarterly earnings calls that their professional customers do not see signs of a slowdown and their backlog remains healthy.

One of my main hypotheses behind the strong home remodeling trend is that people tend to stay at home more often as their working schedule changed after the pandemic. Also, many homeowners choose to stay at their homes and not sell in light of the housing market frenzy. Instead, many homeowners likely chose to do renovation projects to improve the quality of living in their existing homes.

However, the main reason behind strong remodeling stands a trend of aging housing stock in the U.S. The median age of an owner-occupied house in the USA stands at 39 years according to 2019 American Community Survey compared to 31 years in 2005. This is strongly bullish for the remodeling market, as aging structures need frequent repairs, adding new amenities and replacement of old components. The aging homes trend will likely persist and provide a strong tailwind for Home Depot from medium- to long-term.

Home Depot’s Supply Chain Buildout

Back in 2017, Home Depot unveiled a five-year plan to enhance its supply chain by building out distributions and warehouse centers. The most notable thing in this initiative is the shifting focus toward the Pro ecosystem as an engine of growth. Typically, professionals come to shop at HD as a last-minute resort for unplanned purchases, if something breaks or due to missing materials. Home Depot wants to change this view and to be an all-around, one-stop source for materials and tools for Pros right from the start of their home improvement projects.

Specifically, Home Depot started building flatbed distribution centers that can supply necessary project materials in large quantities/assortments for Pro’s planned purchases. The company also created a B2B website, separate salesforce, loyalty programs, credit and quote center – all dedicated to Pros only. I think HD is just starting with Pros and has a tremendous opportunity to take market share from its competitors. This is because the supply materials market for housing projects is very fragmented, meaning Pros typically have to go to multiple suppliers to get what they need. By creating one source of supply, Home Depot is removing a lot of friction and inefficiencies that professionals are facing, creating a superior value proposition. This is also one of the reasons Home Depot updated their total addressable market (TAM) from $450 billion to $900 billion in 2022. This initiative is just beginning to take hold, as the company continues to evaluate and build more of these Pro-focused distribution centers.

The other thing that Home Depot did was to significantly improve their market delivery operations (MDO) centers, which deliver bulky products to customers’ homes. Before, HD outsourced its deliveries to third parties, which created frictions and low satisfaction among consumers since it would be often too late to fix a problem when it becomes known to Home Depot. By gradually taking over ownership of deliveries from start to finish, HD is aiming to improve delivery times and customer satisfaction, creating more demand for bulky products (e.g., furniture, appliances).

Another secondary effect of building out distribution centers for Pros is substantial improvements in retail store productivity. Before having resources dedicated specifically to Pros, professionals would come to the store and take products off the shelves. Under this scenario, HD would have to load and unload large quantities of material back and forth, which was highly inefficient and costly. By shifting this bulk purchase activity to flatbed distribution centers, this inefficiency vanished and stores can focus on high-margin activities instead.

In particular, HD is constantly reviewing its line of products and how and where they are displayed in its stores to drive sales and improve store productivity. More recently, Home Depot initiated their “get store right” project, which is about space allocation on a macro scale, such as freshening assortment, removing products that do not sell well and showcasing goods that are in high demand.

Finally, Home Depot is fortifying further its wide economic moat by not only being a low-cost home improvement retailer, but also offering products that cannot be found elsewhere. Over the past five years, the company completed numerous exclusive deals with its suppliers for various innovative products, such as paint and wiring, among many others. This further enhances the value proposition for Pros and convinces them to do more business with Home Depot long term.

Acquisition of HD Supply

At the end of 2020, Home Depot acquired back HD Supply, which was spun off in 2007. Doing so, Home Depot combined the number one multifamily leader in the maintenance, repair and operations (MRO) market with its own business which was number two. The MRO business primarily targets multifamily housing along with hospitality, healthcare and government facilities, which typically involves capital refreshes. With this acquisition, Home Depot picked up a lot of vertical opportunities that it did not participate in. As a result, HD almost doubled its TAM for MRO business from $55 billion to $100 billion. The idea is to build more relationships with Pros working on the MRO side and win more projects in the future. There is a high opportunity for HD to take market share, as it reintegrates HD Supply into its operations.

Valuation

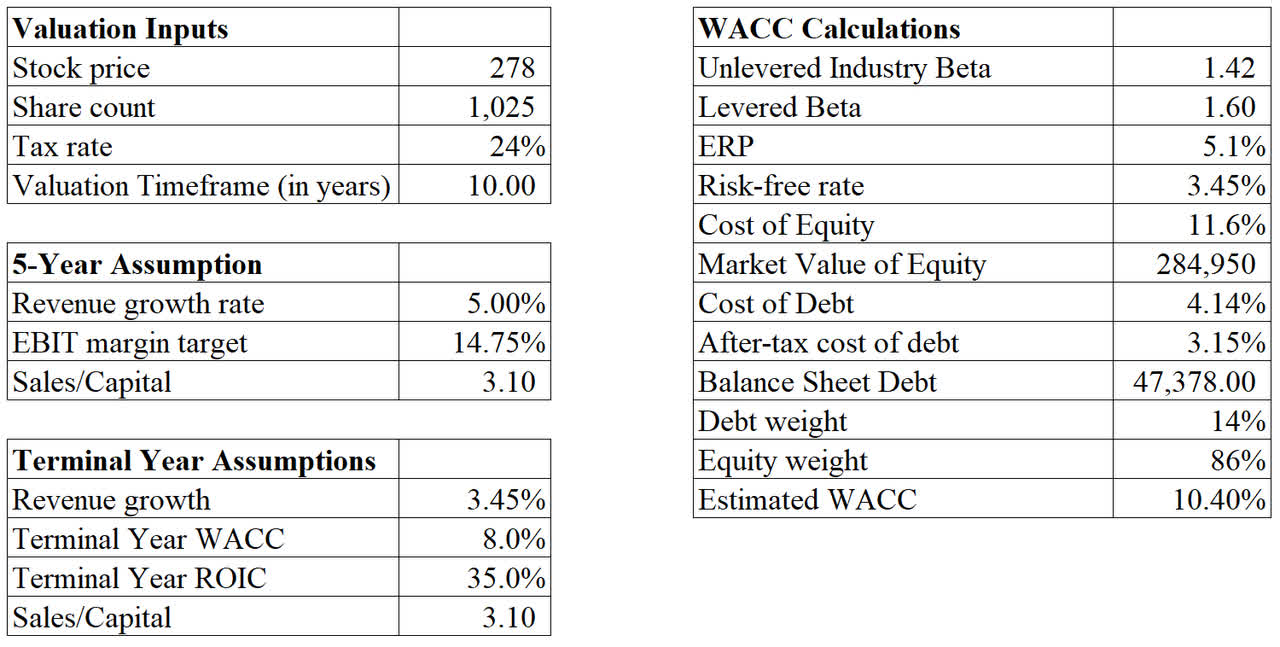

To value Home Depot, I make the following key assumptions in free cash flows to the firm’s DCF model:

Table 2. Home Depot’s DCF Valuation Inputs and Assumptions

Home Depot’s Discounted Cash Flow Valuation Assumptions (Author’s Calculations)

The most important levers from table 2 are revenue growth rate, EBIT margin target, the terminal year ROIC, and the cost of capital. In this valuation, my long-term growth is equal to a 10-year Treasury bond rate of 3.45%. The ratio for sale/capital is equal to the average for the last five years while unlevered industry beta of 1.42 comes from Professor Damodaran’s database. I assume that the revenue growth rate and EBIT margin in the first five years will approximate to Home Depot’s averages before the pandemic, which were 5% and 14.75%, respectively.

Given these inputs, the DCF model I came up with gives an upside of about 7% from the current stock price.

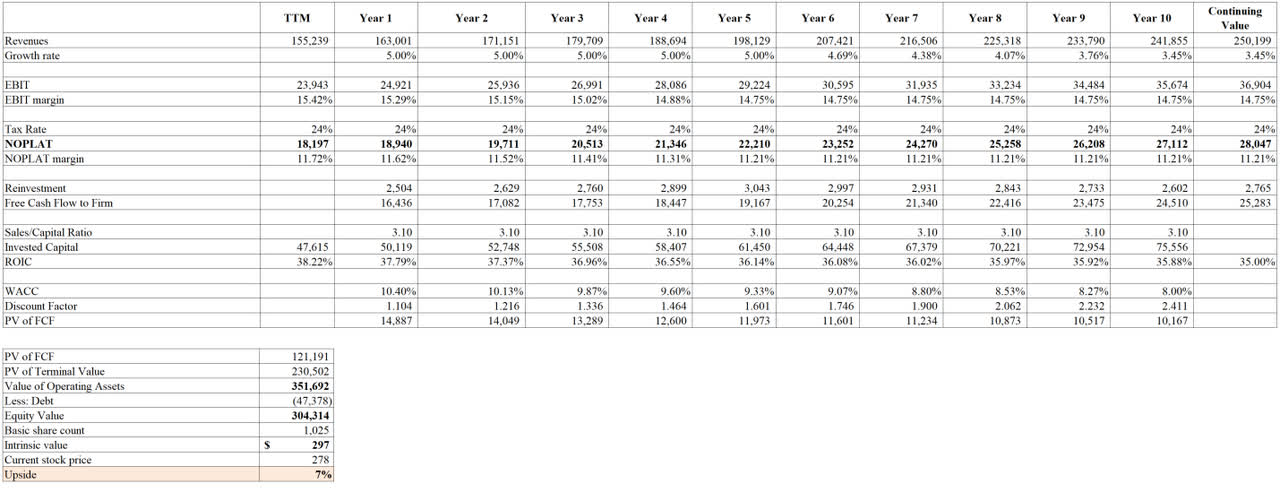

Table 3. Home Depot’s DCF Valuation Output

Home Depot’s Discounted Cash Flow DCF Valuation Output (Author’s Calculations)

I included the link to the Dropbox spreadsheet that you can download and alter key inputs. I also show calculations of invested capital and return on invested capital in this sheet.

The most important driver of higher intrinsic value is higher EBIT growth rates through improved margins and top-line growth. Note, if a 10% growth rate in EBIT is achieved through a combination of higher sales growth (7%) and much higher margin (18%), Home Depot becomes about 50% undervalued. However, an 18% operating margin is something that will be very difficult to pull off.

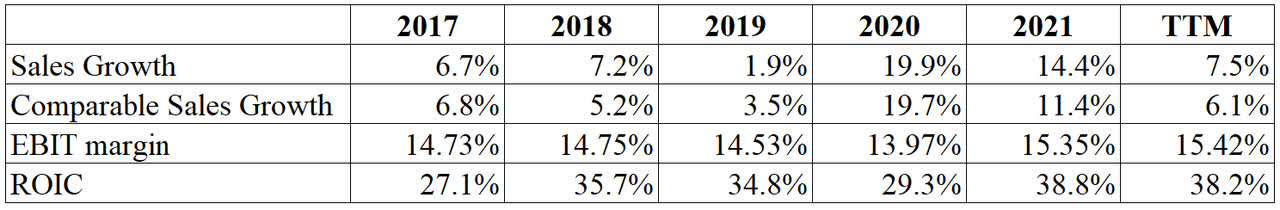

Table 4. Home Depot’s Sales Growth, Operating Margins and ROIC

Home Depot’s Sales Growth, Operating Margins and ROIC (Home Depot’s Filings and author’s calculations)

Looking at table 4, it is clear that HD is in the midst of reversion and the numbers will likely settle somewhere in the middle between pre-pandemic and current figures. While my base case scenario indicates about a 10% undervaluation, there exists a subjective probability that Home Depot will achieve better EBIT growth. So in an outcome-weighted case, HD could be anywhere between 10% and 50% undervalued, depending on your view and probabilities for each scenario. I deem an 18% EBIT margin very unlikely at the moment, which makes HD anywhere between 10% and 20% undervalued at best.

One notable thing about HD’s valuation is its capital structure, which is highly skewed towards common equity. I think Home Depot can optimize further its capital structure by having higher debt to market value of equity ratio, which will lower its cost of capital and boost intrinsic value. Also, a recent rapid increase in the risk-free interest rate is definitely hurting common equity valuations. If interest rates come down and Home Depot, Inc. optimizes its capital structure, its cost of capital will be significantly lower and this will boost HD’s intrinsic valuation by a wide margin.

Relative Valuation

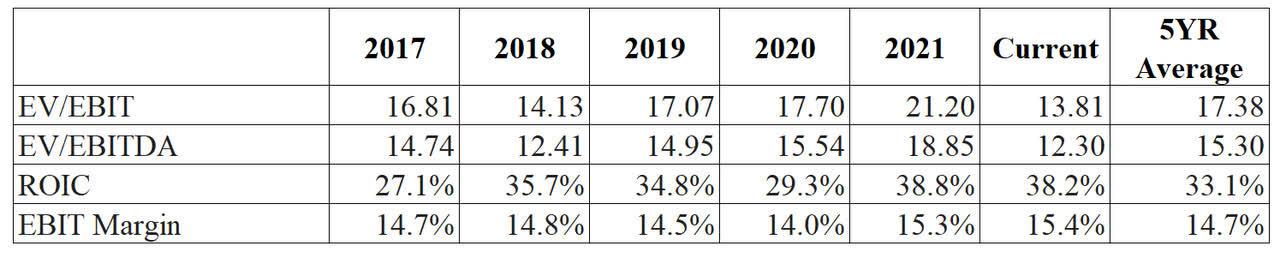

Table 5. Home Depot’s Historical Relative Valuation

Home Depot’s Historical Relative Valuation (Morningstar, except for ROIC and EBIT Margin, which are based on author’s calculations)

When comparing Home Depot’s relative valuation metrics across several years from table 5, the stock is likely undervalued by about 20%-30% given its higher ROIC and margin. However, the current high ROIC will likely revert back to pre-pandemic levels given how much operating leverage HD enjoyed as a result of high comparable sales over the last two years. If the market expects ROIC to come down to 35% and there is a slight decline in operating margin, we are likely looking at maximum 10%-20% undervaluation depending on the metric you look at.

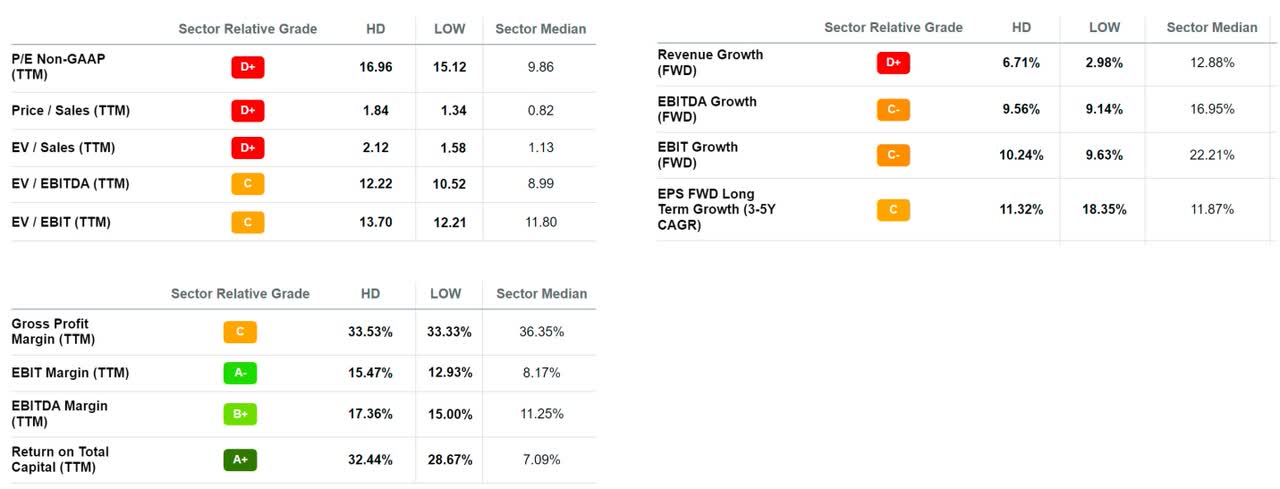

Figure 2. Home Depot’s Relative Valuation

Home Depot’s Relative Valuation (Seeking Alpha)

Looking at figure 2 and comparing the company to its peers and Lowe’s in particular, Home Depot stands out by having a slightly higher EV/EBIT multiple, which is rightly justified by having better EBIT margins and better return on total capital. However, HD’s return on capital is substantially higher than that of its consumer discretionary sector. To me, return on total capital is the most important metric that will drive HD’s future valuation and this alone justifies a higher EV/EBIT multiple for HD (and LOW for that matter). However, Home Depot is expected to trail its sector with respect to future EBIT growth, which can partially explain why its multiple is not significantly higher compared to its sector. Overall, it is not entirely evident if HD deserves a higher multiple given what is expected of the company at the moment.

What Should Investors Know About Home Depot’s Dividend?

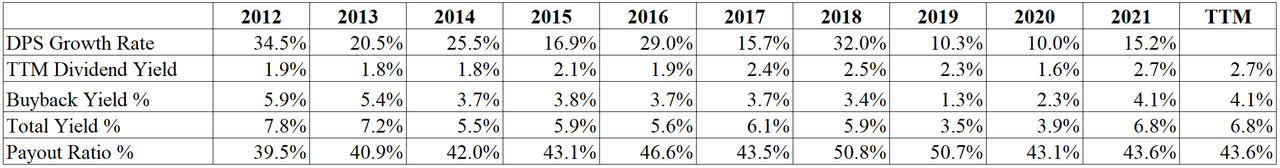

Home Depot has been paying dividends on a quarterly basis since 1987 with no interruptions. HD has steadily increased its dividends over the years and its 5-year growth rate is 16.6%. The current dividend yield stands at 2.66% and the forward dividend yield is 2.75%, which is slightly higher than the sector median forward yield of 2.52%.

Table 6. Home Depot’s Dividends History

Home Depot’s Dividends History (Morningstar)

Even though HD’s payout ratio of 43.6% is consistent with its historic averages, this number is higher than the 30% payout ratio for the consumer discretionary sector. However, Home Depot carefully manages its cash flows with operating cash flows covering all of its financing and investing needs, including payments of dividends. Given such relatively conservative cash flow management, HD can afford paying even higher dividends if it chooses to, which it can achieve by reducing stock buybacks or taking on more debt to fulfill its CapEx needs. In fact, as I argued before, the company would greatly benefit from taking on more debt to tilt its capital structure towards a cheaper source of capital compared to common equity.

Is Home Depot A Good Long-Term Investment?

Home Depot is currently close to fairly valued. HD can be an addition to the portfolio of an investor looking to take advantage of favorable trends in the home remodeling market, should market conditions improve in the future and HD demonstrates better EBIT growth. One of the features that makes Home Depot an attractive long-term investment is how management’s incentives are aligned with those of its shareholders.

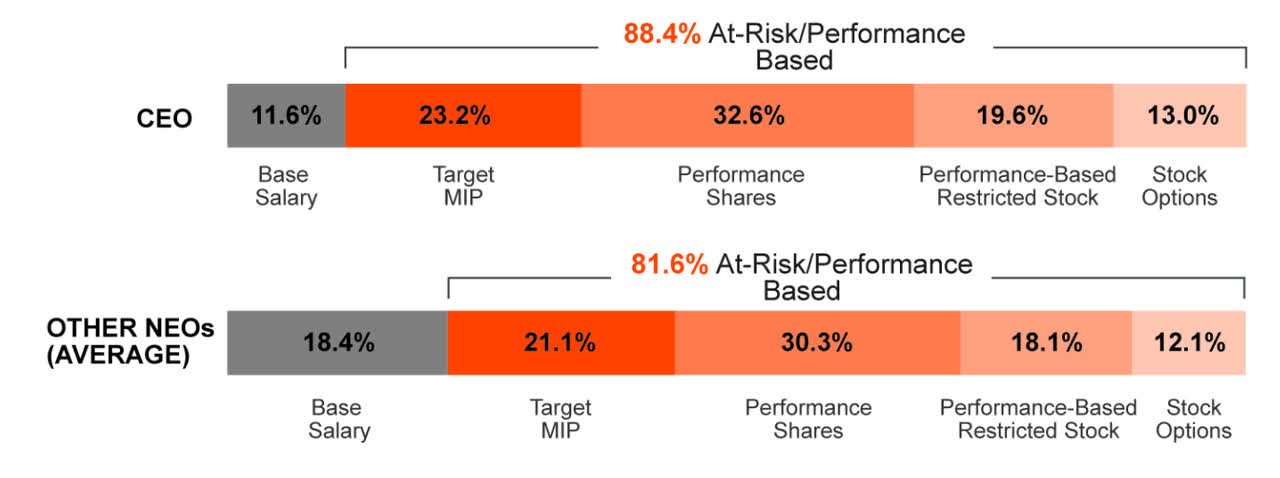

Figure 3. Home Depot’s Management Compensation

Home Depot’s Executive Management Compensation (Company’s Filings)

About 50% of management compensation is tied to meeting various operating targets. Among these targets are the growth in operating profits and return on invested capital, which are two of the most important metrics that ensure growth in intrinsic value. It is rare to find a company that explicitly places emphasis on these two important value creation indicators.

Is Home Depot Stock A Buy, Sell, Or Hold?

I rate Home Depot as a Hold. HD offers a robust forward dividend yield of 2.75% with a possibility of modest capital appreciation under my baseline scenario. As consumer demand normalizes due to previously high spend and rising prices, HD is currently valued at where it should be with a possibility of 10% to 20% max upside. Because this upside does not provide a sufficient margin of safety, I do not rate HD as a Buy.

Overall, I will be willing to revalue the company under the following conditions:

- Growth rate in operating profits shoots up to 10% and ROIC staying above the 35% mark.

- Lower cost of capital through higher leverage, lower equity risk premium, lower interest rates.

As mentioned before, the growth rate for EBIT of 10% can produce approximately 50% of upside from the current levels. This EBIT growth will have to come from high comps and even stronger operating leverage than what HD historically demonstrated. It remains to be seen if Home Depot is capable of pulling off such impressive results in the future after the breakneck growth in 2020-2022.